Newsletter 18/2024: CBAM (Carbon offset mechanism at the border)

In one of our last newsletters last year, we informed you about the new obligation for importers of certain commodities to report their carbon footprint, the so-called CBAM.

In one of our last newsletters last year, we informed you about the new obligation for importers of certain commodities to report their carbon footprint, the so-called CBAM.

The date of 31.1.2024 is approaching, by which it is mandatory to fill in the appropriate reporting in the system for the period 1.10.-31.12.2023.

So what are the essential new developments and what should you as importers ensure and do?

Does the reporting obligation apply to you?

If you imported and cleared for free circulation one of the designated HS codes (customs nomenclature code) in the last quarter of last year, see below, you are subject to this obligation.

However, you do not need to submit a "nil" report, i.e. if you normally import the goods concerned but did not import them in the reporting period, you do not need to report a "nil".

Which goods are covered by the CBAM Regulation?

- Iron & Steel

- Aluminium

- Cement

- Fertilizers

- Hydrogen

- Electricity

Clear identification of whether the goods fall under the obligation is best verified through Taric on the Customs website:

https://www.celnisprava.cz/cz/aplikace/Stranky/taric-cz.aspx

After completing the nomenclature, the List of Measures will show whether or not the code applies to the obligation.

Where do I report? Do I have to register?

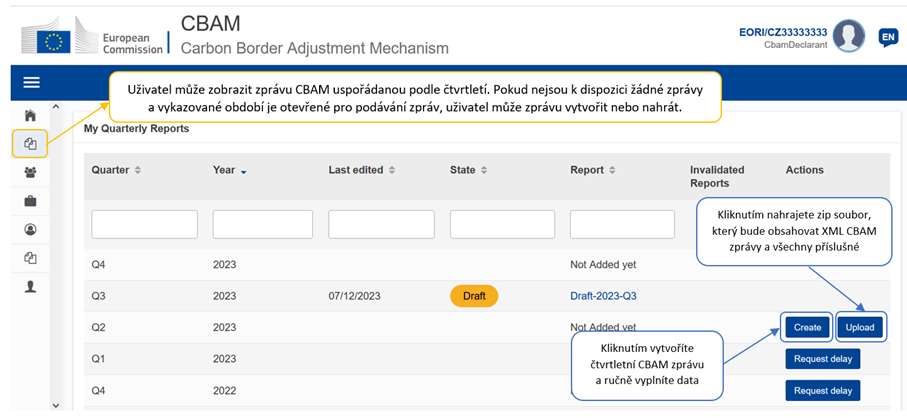

Quarterly CBAM reports must be submitted via the CBAM Trader Portal. The CBAM Trader Portal acts as a temporary register for CBAM. Access to the portal is only granted to importers or indirect customs agents who are registered in the UUM&DS (EU Unified User and Digital Signature Management System) to ensure identity verification at login.

If you are not registered in the UUM&DS, you must first register there.

The persons concerned will request access to the CBAM Trader Portal via the electronic form "Request for access to the European Trader Portal" and, on the basis of this request, the Directorate General of Customs will register them in the UUM&DS system.

Instructions for completion are directly included in the form. It is recommended to register not only in the CBAM portal (last bullet point) but also in the BTI portal, which can be used to request binding information on the classification of goods.

For registration, choose an available and permanent email address, it is a login and unique identifier for the system.

According to the latest reports, registration takes 2-3 weeks, so don't hesitate too long.

If you have any questions about the registration process, you can contact the Directorate General of Customs at:

Reg_uumds@cs.mfcr.cz

What does it mean that the register is temporary for a transitional period?

Until 31 December 2025, this is a so-called transitional, trial period. During this period, only the notification obligation applies, not the payment obligation. At the same time, no one will check and verify the correctness of the emissions. After the end of the period, the values will be verified in the full-fledged CBAM module and CBAM certificates will be sold based on the reported values. Without these certificates it will not be possible to import goods.

What is the content of the report and where do I get the correct values?

Reporting :

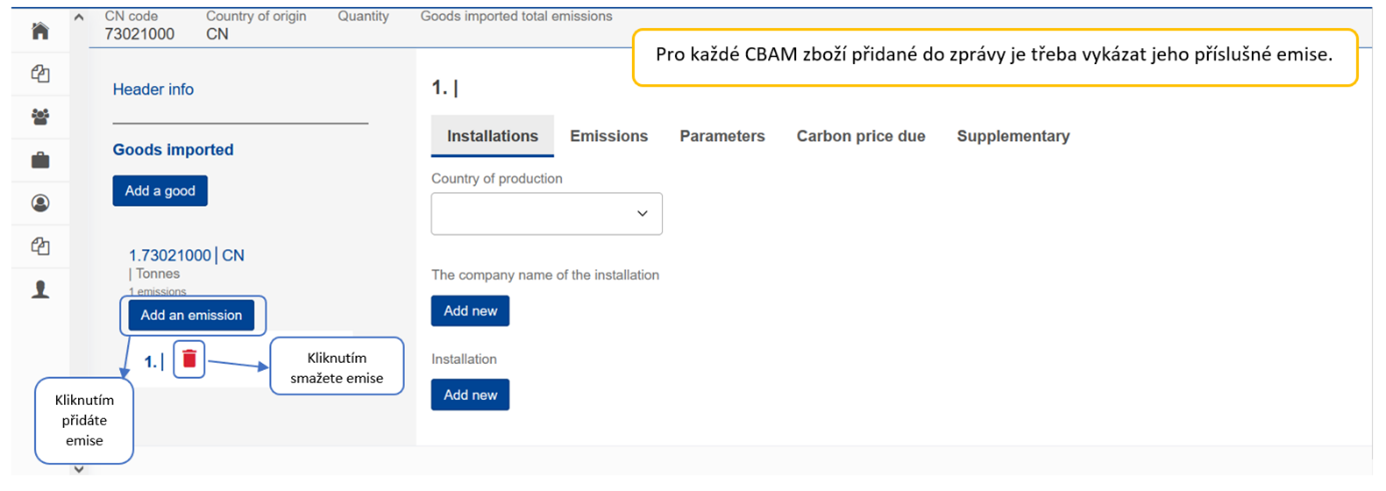

- the total quantity of each type of CBAM goods;

- actual total embedded emissions;

- total indirect emissions;

- the carbon price payable in the country of origin for the emissions embodied in the imported goods (including relevant precursors, where applicable), taking into account any discount or other form of offset.

You can get this information from the supplier. In order to ensure that all the required information is available, the notifying declarant should request from the manufacturer the information contained in Annex IV of the Implementing Regulation. The Commission services have compiled this information into an optional communication template (in Excel format) to facilitate the communication of information between operators and importers. This template is available on the Commission's website: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

Guidance for EU importers will be available in 24 official EU languages. Guidance for non-EU manufacturers will be available in English, French, German, Polish, Spanish, Italian, Arabic, Korean, Mandarin, Hindi and Turkish. Unfortunately, so far it is only available in English: here

What if the supplier hasn't given me any values?

Reference, default values can be used for the first 3 reporting periods.

Default values for the CBAM transition period between 1 October 2023 and 31 December 2025

It will then only be possible to use the default values for 20% of the emissions. It is therefore recommended to contractually address the obligation to provide information with the supplier, the manufacturer.

How will BDP-Wakestone help me?

As an indirect customs declarant, we can complete the report for you. It is already clear that in this case we will have to give you consent to this delegation and you will have to identify us as the declarant in the system after registration.

Unfortunately, as freight forwarder and declarant we have no influence on your business relationship with the manufacturer, so we will continue to request values for the CBAM report from you unless they are part of the commercial documents. At the same time, it is mandatory to report all quantities of the product/HS code in question from one manufacturer by one declarant. So if you import Š screws from manufacturer V in volume O, it is not possible to report the volume O in a given period in a split way, by multiple declarants.

We believe that we will soon offer you the conditions under which you will be able to use our services.

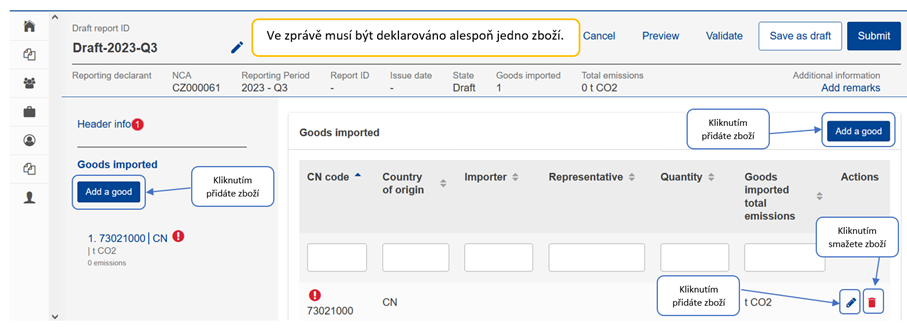

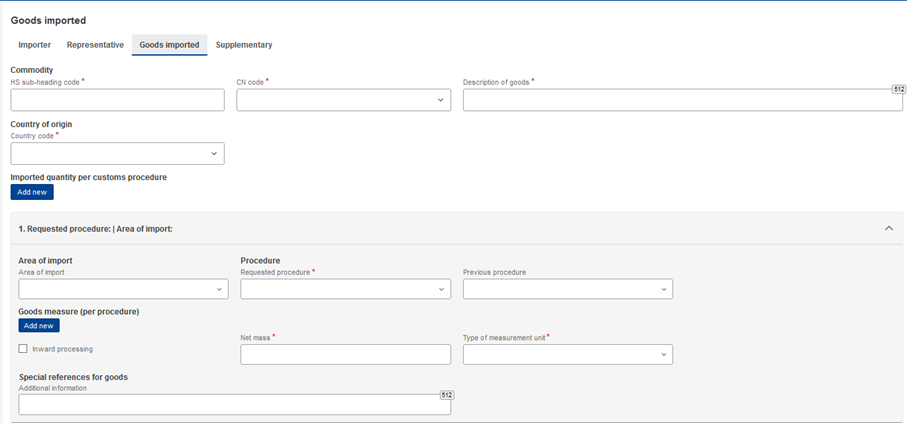

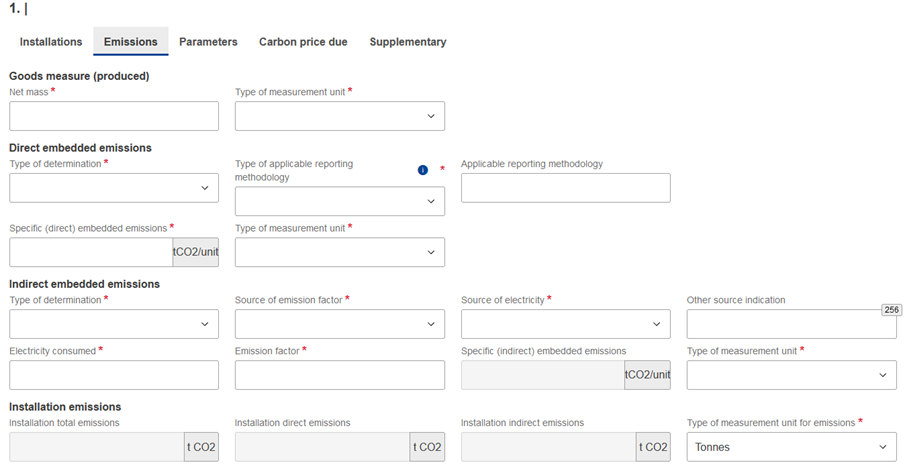

STEP BY STEP / SYSTEM PREVIEWS

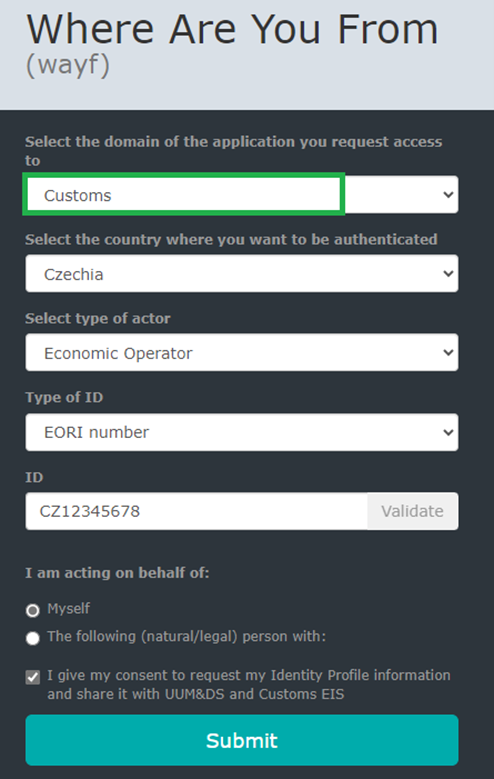

After registering for the system, you will receive a link from Customs to activate it. Logging into the reporting module has a small catch at the beginning, which we would like to draw your attention to. You must select the CUSTOMS module and not CBAM. The CBAM module is and will be for the "live" version, i.e. after the trial period.

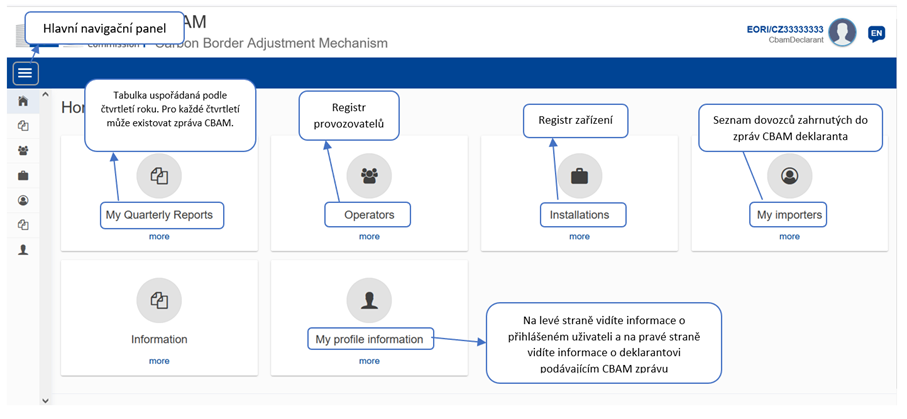

MAIN INTERFACE

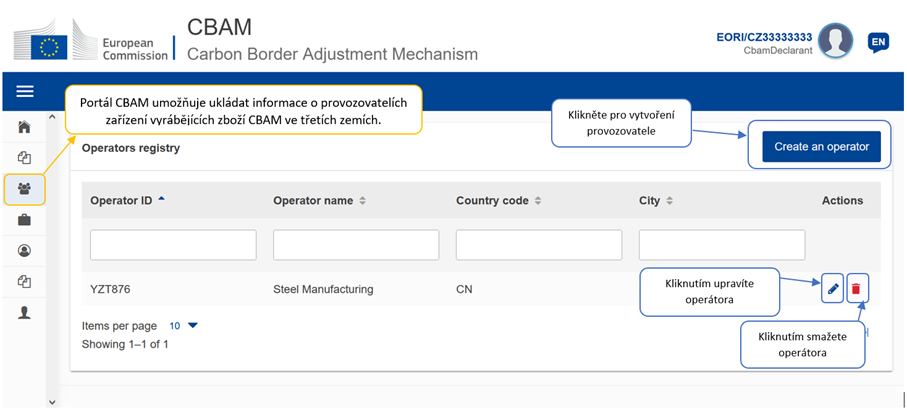

CREATION OF AN OPERATOR (MANUFACTURER)

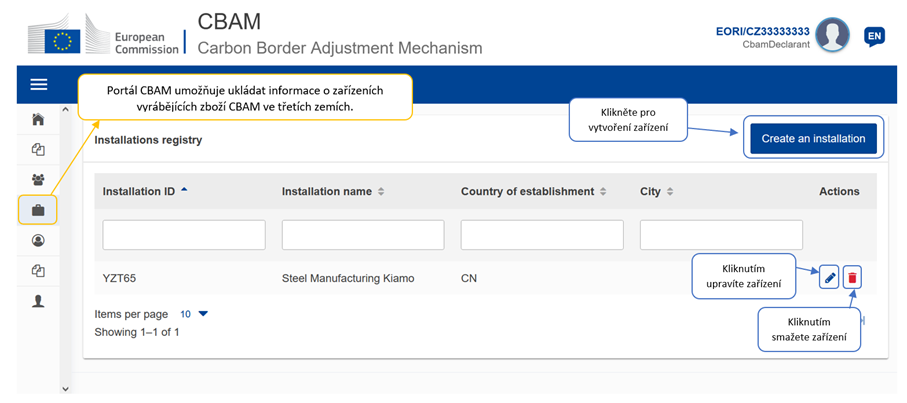

CREATING AN INSTALLATION

(An operator may have multiple installations e.g. different production plants with different production emission values)

Further material on this mechanism can be found in the downloads section, either a set of FAQs or supporting information.

We are happy to help you with any questions you may have, please do not hesitate to contact us.