Newsletter 22/2024: Actual situation in international transport

In today's edition we look not only at what's happening in the skies, rails and seas, but also at the new phase of the ICS 2 rollout.

AIR TRANSPORT

While Lufthansa is counting losses for the first quarter of 2024, which was marked by weaker volumes supported by staff strikes, the airline is generally expecting an end to the Labour Day holiday in China, which lasted from May 1 to 5. It was preceded, as every holiday is, by a price increase supported by the supply of goods. Customers, on the other hand, expect prices to start falling after the holiday. And we confirm that they are getting their wish. And they are also coming true for airlines, which are feeling the increase in global demand and increasing capacity.

The US tradelane is stable, with prices here half of those in the Far East on the import route.

OCEAN TRANSPORT

Key routes from Asia to Europe are busy again. After a few months of some service stabilisation, albeit with extended transit times and longer route surcharges, there is again a scramble for space on ships and prices, including surcharges such as the Peak Season Surcharge, are rising steeply. There are several reasons for this, just to name the most important ones:

- Importers are counting on longer shipping times and have accelerated loading at their suppliers in China a few weeks earlier

- In an effort to prevent price drops, sailors have skipped several departures (blank sailings)

- In China, there is a shortage of empty containers for loading goods (shipowners preferentially load load loaded containers onto export ships from Europe)

- In many ports in Asia, including the largest, ships wait 2-5 days to unload (port congestion), leading shipowners to make further changes to the schedules of specific ships (skipping congested ports)

As a result, ships are being unloaded from some Chinese ports until the end of May and the predictability (regularity) of schedules has been significantly reduced.

The classic market condition: lack of capacity = rising prices has been activated very quickly. Already on the last Friday in April, the Shanghai index of Far East spot rates rose more sharply than at any time since the outbreak of the Red Sea security crisis. The index jumped nearly 10 percent from the previous week. This was before the general increase in tariffs for traffic from the Far East to Europe came into effect on May 1. The next general increase (whether called PSS/Peak Season Surcharge or otherwise) is already announced for May 15.

It is expected that the situation with the place will be difficult until the start of Golden Week (1.10.24), i.e. over the whole summer/holiday season.

We highly recommend early planning ahead of the upcoming season, we will be happy to consult with you on the best dates and shipping method to ensure you have your goods stocked in time.

There is always room, but there is and will be a price...

On the positive side, even in these difficult times, there is some pleasant news: the French shipbuilder CMA-CGM is opening a new service between Asia and Europe from June, with significantly shorter transit times than the general standard. For example, the transit time from Ningbo to Europe (Koper) should take "only" 38 days (the usual t/t to Hamburg is currently around 48 days or more), from Busan to Koper 36 days, and from Shekou (Shenzen/Yantian area) to Europe (Koper) will take only 31 days, which is also 10 days faster than the classic service to Hamburg. It is also faster to reach selected ports in Asia for export. The short transit time is due to routing through the Suez Canal.

In addition to imports from Asia, the situation is also difficult in the case of exports and imports to the Middle East (Arabian Gulf) and the Indian subcontinent, where it is necessary to book 2-3 weeks in advance. There is relative calm on transatlantic routes despite the Baltimore accident.

RAIL TRANSPORT

The volume of rail shipments from China continues to increase, mainly due to extended transit times at sea. This leads to more frequent departures from terminals and increased capacity, which applies not only to FCL shipments but also to LCL collection containers, which offer ample space and allow departures up to twice a week.

The increase in volume unfortunately has a negative impact on transit times, which are extended by delays at the Malaszewicze terminal, through which most rail trains from Europe to China pass. Here, containers often wait 7 to 10 days for trains bound for the Czech Republic, which means that transit times are currently 37 to 42 days door-to-door. For urgent containers, we can shorten the transit time by delivering containers on direct tractors straight from Malaszewice.

Import Control System 2 (ICS2)

In last year's newsletter 04/2023 we informed you about the convergence of European customs systems, digitalization and the shift of reporting of shipment parameters closer in time to loading. The message was as follows:

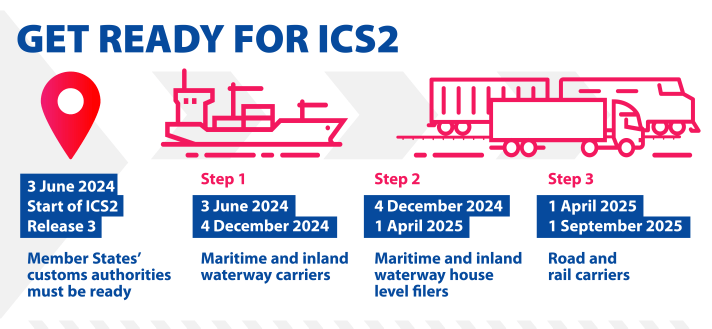

ICS-2 is in its 2nd phase as of 1 March 2023, where instead of previously declaring mail and some urgent air shipments, all air cargo is now required to be declared. Other modes of transport will be added from 1.3.2024, as this should also be the date when the ICS-2 system will be linked to the NCTS. Obviously, the dates may shift by a few months during the implementation, but the trend and the target state is set.

So now, on the basis of the latest information, we clarify and point out that from 3 June this year, the obligation of import customs pre-declaration for shipments going to the EU by sea applies for shipper-secured (Master B/L) and from 4 December for shipper-secured (House or FIATA B/L).

Thus, only sea shipments are added to air shipments for the time being. Rail and land will be postponed to 1.4. 2025

What does this mean for you, what is changing?

Any shipper sending a shipment from a non-EU country (including, for example, the UK) by sea to the EU will be required to send details of the shipment to the European customs system via an intermediary from the above date. The key data will be the harmonised tariff code, i.e. the HS code.

We therefore recommend that you request the HS code that will be used to declare your overseas shipment early and in advance, ideally when ordering your shipment. If you have any doubts about the correctness of the HS code or the correct classification, or are unable to find the HS code at all, please contact us and we will be happy to help. The exact identity of the consignor and consignee, including the EORI, will also be provided. Your EORI will need to be part of the commercial invoice.