Newsletter 01/2026: Actual situation in international transport

What will the new year bring? We believe and hope for ourselves and for you that it will bring increased supply chain reliability, rates that are attractive to both customers and providers, and thus an innovative market environment. As usual, we will keep you informed of developments. Let's take a look at what is currently driving the world of logistics:

CHINESE NEW YEAR

AIR TRANSPORT

Import rates for air freight from China to Europe reached their lowest level since June 2025 during Christmas and the end of the year. However, since the beginning of our year and with the Chinese New Year approaching, the trajectory is reversing, and thanks to growing demand, this trend is likely to continue. This will continue until the Chinese New Year. Cheaper shipping costs can be expected for shipments that will depart during or even after the holiday. On the other hand, demand is lower on routes from the United States. For importers from this destination, however, this means low rates and free capacity.

We can also see a favorable capacity situation in the export direction, thanks to which rates are attractive not only to the Far East and China, but also to most major destinations throughout Asia, the Middle East, and the US.

OCEAN TRANSPORT

In recent weeks, we have been monitoring shipping companies' efforts to raise rates. Anyone who has been involved in maritime transport for more than a year is familiar with the rate curve before CNY. As demand grows, so do prices. What does the slowdown in growth in the second half of January mean? There are several ways to interpret this. Demand is not as high. In this case, we can expect the traditional step of "blank sailings," i.e., taking ships out of service (and moving them to more attractive trade lanes). Or it may be an attempt by shipowners to increase volume and create a backlog so that they can fill ships with these goods during and after the CNY. In both cases, we may see so-called rolling, i.e., postponing shipments until after the CNY. It is good to keep this in mind when looking for a suitable solution.

Space on ships is not the only factor determining whether and how shipments will be made. Every year, we see a shortage of trucks for loading and transport to the port. This year, there is also a shortage of empty containers for loading, at least according to the first shipping company to report this phenomenon.

The second hot topic is Suez. In particular, the Gemini alliance (Maersk and Hapag, not to be confused with Google's artificial intelligence) is floating trial balloons about the passage of this or that ship, creating the impression that the world will soon return to business as usual, i.e., the canal. However, we expect a gradual and cautious return. This step means, in fact, a further release of capacity onto the market and also (at least) a temporary overload of European ports, neither of which the market and shipowners can afford at the moment.

Winter has added to the already unfavorable situation in European ports. The end of the climate crisis could not have come at a less opportune time. Since January 2, 2026, we have been closely monitoring the situation in Hamburg, which has been reporting heavy snowfall since the beginning of the year and is therefore not accepting containers. Other ports (Benelux, Bremerhaven, Wilhelmshaven) are not far behind, although the situation there is not as dramatic as in Hamburg. So far, the best situation in terms of subsequent transport is the Polish port of Gdansk, which is reporting delays of approximately 12 hours.

For the latest situation, follow our reports in the eSTONE app.

We are receiving positive news from the Premiere alliance, whose reliability is gradually improving and which has prepared new deployments, i.e., a new arrangement of services and capacity deployment, effective April 1. This should improve reliability.

RAIL TRANSPORT FROM THE FAR EAST

"F-GAS REGULATION"

In 2024, the EU decided in Regulation 2024/573 that fluorinated greenhouse gases (so-called F-gases) would disappear from the market by 2050. The regulation applies not only to fluorinated gases themselves, but also to products and equipment that contain these gases or are operationally dependent on them. Importers and sellers of air conditioners, refrigeration equipment, and heat pumps, in particular, should take note.

- registration of the importer on the EU F-Gas Portal,

- a valid import authorization and, where applicable, an allocated quota,

- correct and complete information on F-gases in the customs declaration.

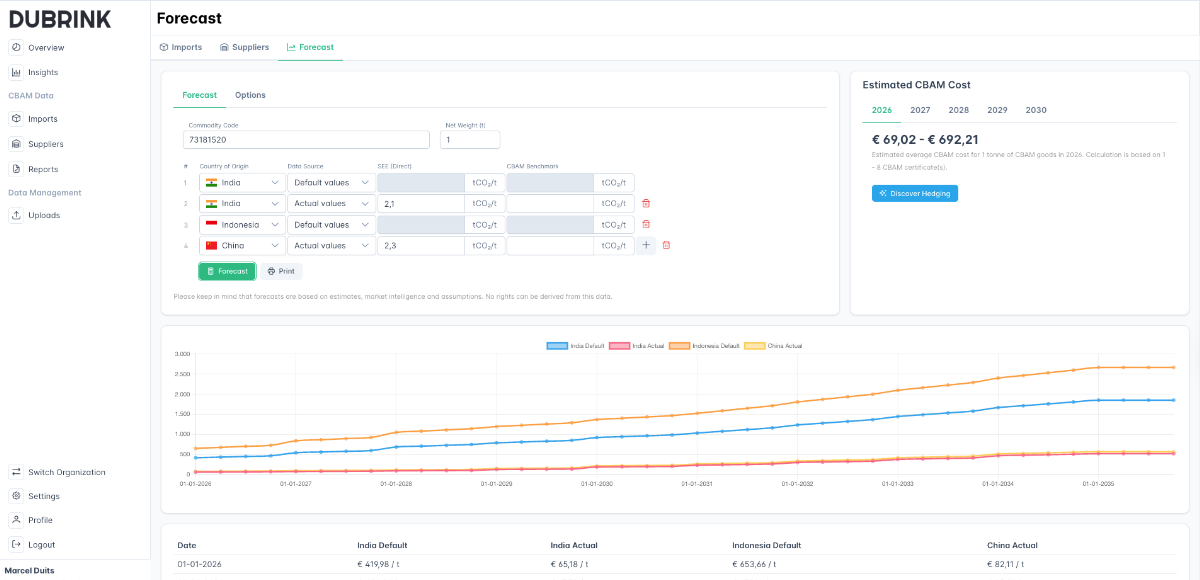

CBAM

Another problem is that companies will only gain certainty about the recognition of actual emission values after a significant time lag, potentially as late as 2027. Until then, many companies will value and sell their products based on today's margins, unaware of the risk of additional costs that are "quietly" accumulating in the meantime. These companies may then face a significant one-off surcharge in 2027. Conversely, companies that are aware of the risks are struggling to remain competitive today, as the surcharge of around EUR 700 per ton puts them at a price disadvantage.