Despite the approaching Chinese New Year, rates are stagnating or even falling. This is particularly true in China, where demand is not as high. Airlines are even canceling scheduled flights, which paradoxically may create a short-term shortage of space, but unless it is urgent express transport, the conditions and rates are very attractive, and unlike in previous years, there is no reason to worry financially about air imports.

Only in Taiwan is the situation slightly different, with capacities relatively full. However, even here, if you are not in a hurry to depart before CNY, departures at the turn of the month are advantageous in terms of rates.

On the other hand, the situation is not favorable on the east coast of the US, where thousands of flights have been disrupted due to adverse weather conditions. Airlines are primarily trying to deal with passenger flights and stranded passengers. At the same time, demand increased at the beginning of the year. This combination clearly leads to an increase in airfares on the east coast and complications with the delivery of goods. It is therefore recommended to plan air transport in this direction with sufficient time reserves.

Imports from the US remain relatively unaffected by low demand, at least in terms of rates.

RAIL TRANSPORT FROM THE FAR EAST

Unlike air transport, capacity here fills up quickly, and there are only a few spots left on import trains before the Chinese New Year. After that, China will pause, and the next trains will not depart until February 25-28. For goods picked up after the holidays, realistic departures are more likely to occur during the first week of March.

Despite minor problems at border crossings, transit times are stable and remain between 30-35 days door-to-door for piece shipments.

However, please note IMPORTANT INFORMATION regarding the specification of goods known as SPECIFIC CARGO, which are subject to customs inspection by local authorities when passing through Kazakh territory:

If the sender's four-digit HS code is included in the list, then the specific goods must undergo an identification procedure, which means submitting an application for a license that will "exempt" the goods and thus prevent the risk of customs inspection. Such processing takes at least 7 days or more, and in rare cases even several weeks.

These reasons existed before, but inspections were not common, and operators and agents approached this procedure more leniently. The recipient was routinely informed of the risk and it was up to them to decide whether or not to take the risk. Unfortunately, the situation in Kazakhstan has now changed and goods are often excluded from the collection container before loading. Operators and agents require an issued license, a change in the HS code, cancellation of transport and rebooking to another type of transport, or waiting for the situation after CNY, when some estimate that the situation should return to the old ways of last year and inspections may not be as problematic, strict, and frequent.

However, even with a more lenient approach, the rules will continue to apply, and with them the risk of the entire container being returned, so it is advisable for shippers to have licenses in place.

OCEAN TRANSPORT

SITUATION IN EUROPEAN PORTS

The situation in Hamburg and Bremerhaven, which we informed you about in a separate newsletter, remains very similar. The port and multimodal carriers are reporting slightly optimistic news, but before we can write a positive newsletter, they are reporting frost and complications again. The situation is therefore still far from ideal, and operators will continue to face problems to a greater or lesser extent for some time to come. However, the problem has now spread to the port of Gdańsk. It is struggling with a combination of extreme winter weather (icing on cranes and equipment) and the aftermath of January's strikes by Polish road hauliers. The drivers protested against the lack of slots and long waiting times with blockades, which created a huge backlog of containers at the terminal.

Rail carriers are facing great difficulties without exception. Metrans, for example, reports that import capacity is fully booked until February 21, 2026, and the terminal has reduced the number of train slots accepted by approximately 30%.

NINGBO EXPRESS - FASTEST OCEAN SERVICE

Regular readers will surely remember the information about the express service from Ningbo. For others, we would like to remind you that this is a direct service operated from the port of Ningbo, which does not stop anywhere on its way to Europe, passes through Suez, and therefore has a very attractive transit time.

The current planned departure is March 15, with arrival on April 12.

The transit time is therefore comparable to rail connections, and the pricing conditions are also similar.

The advantage is that the goods do not travel through Russia, so there is no need to take sanctions into account. The service also accepts HS codes from the sanctions list and ADR goods.

Please contact us at sales@wakestone.cz for specific conditions, but if you are interested in this particular shipment, do not delay. The ships used for this service are small (their capacity is around 2,500 TEU compared to the current standard of 24,000 TEU) and therefore tend to fill up very quickly.

ROAD TRANSPORT: WESTERN BALKANS

Serbia is also experiencing a turbulent period. The main trigger for the current critical situation was a protest by drivers against the new EU digital system (EES - Entry/Exit System) and strict enforcement of the rules on staying in the Schengen area (max. 90 days within 180 days). Balkan drivers, who spend most of their working time in the EU, quickly exhaust this rule, which has led to deportations and entry bans.

Since Monday, January 26, 2026, freight transport has come to a complete standstill at key entry points into the EU (particularly the Serbia-Croatia and Serbia-Hungary borders).

In addition to Serbia, carriers in Bosnia and Herzegovina, Montenegro, and North Macedonia have joined the protest. Kosovo, which is dependent on transit routes through Serbia, has also been indirectly affected.

Although the blockades officially ended on Friday, January 30, 2026, and the borders are now passable, the first week of February is still expected to see repercussions in the form of queues and delays as thousands of trucks that accumulated at the end of January are cleared.

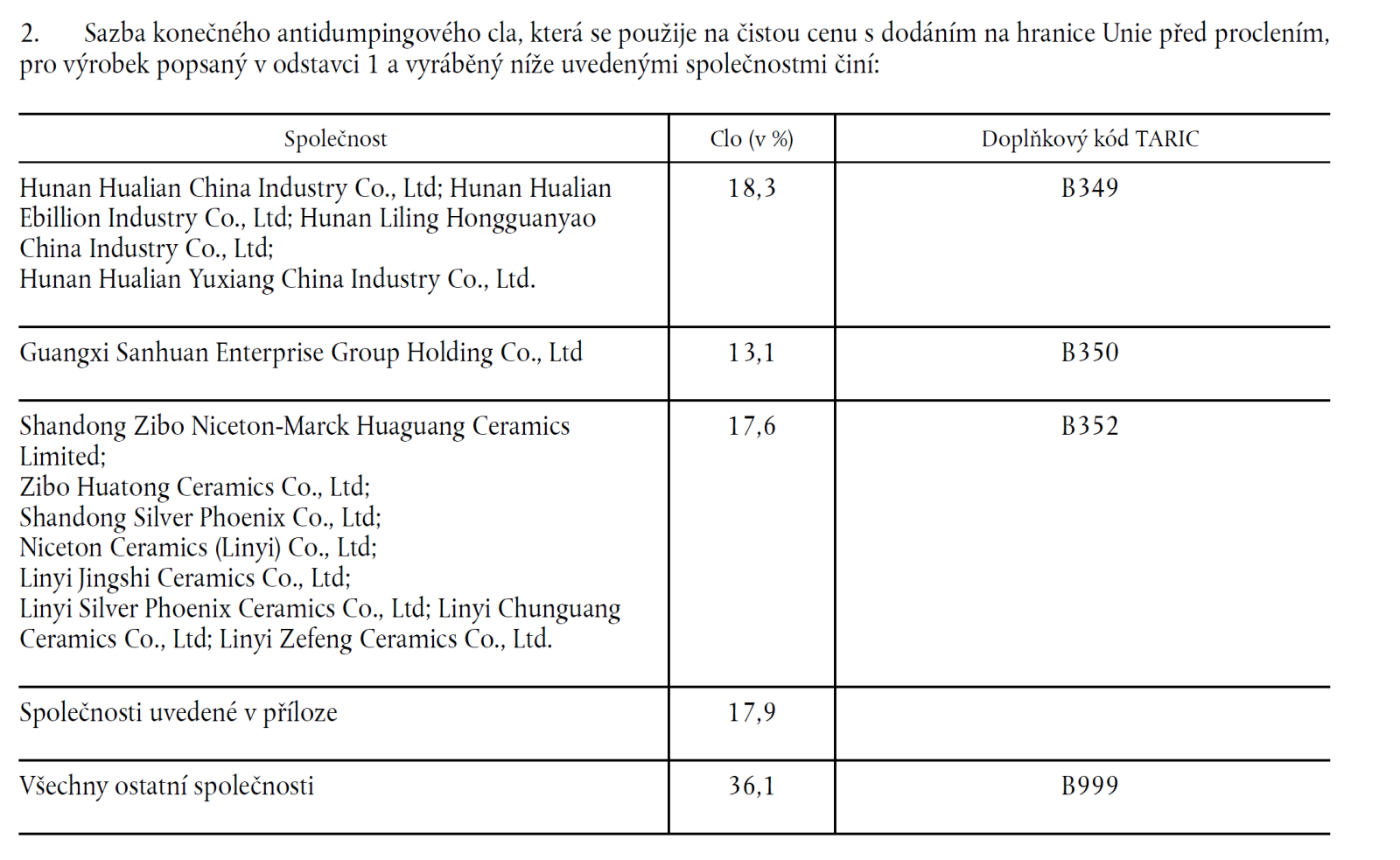

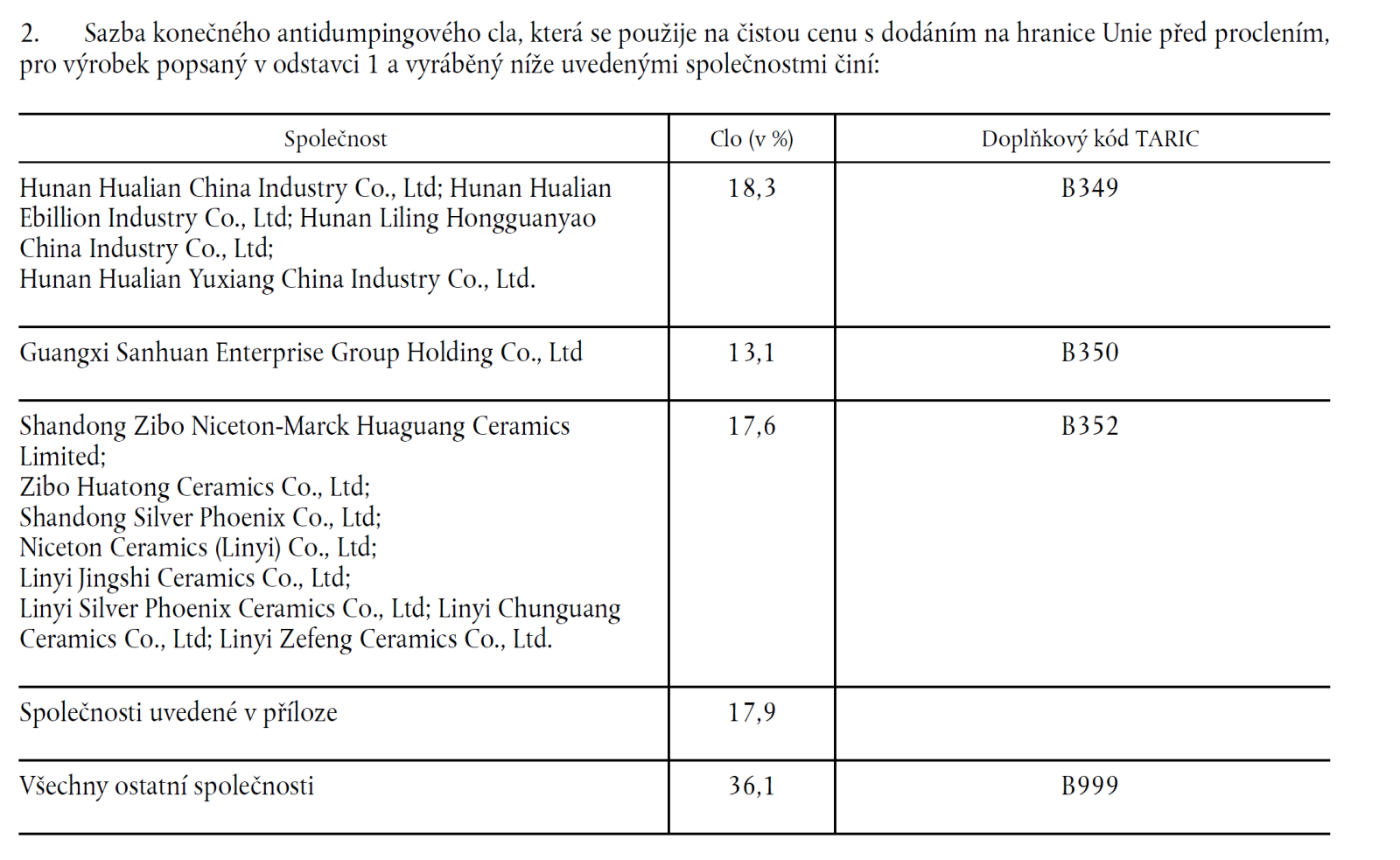

ANTI-DUMPING ON CERAMICS FROM CHINA

There are increasing questions from ceramic importers who are concerned about the introduction of anti-dumping measures on ceramics from China.

The official response from the customs administration is that the EU has renewed and extended anti-dumping duties on ceramic tableware and kitchenware from the PRC on the basis of Implementing Regulation (EU) 2025/1981 of October 7, 2025.

The duty rate is 36.1%, with exceptions for certain companies listed in the regulation.

The duty is then calculated as the sum of the duty and the anti-dumping duty.

However, unofficial information from Brussels corridors suggests that an increase in the anti-dumping duty to 79% is being considered and negotiated.

We will hopefully know more in the spring, as March 18, 2026, is the deadline by which the Commission must impose any measures. Unfortunately, as we know from experience, no consideration is given to the fact that purchasing, transporting, and subsequently entering the EU takes time, and measures of this type sometimes come into effect overnight.

FREE TRADE AGREEMENT EU - INDIA

The free trade agreement between the EU and India has been almost 18 years in the making. Perhaps that is why it is called the "mother of all agreements."

The FTA is designed to improve market access in a wide range of sectors, including manufacturing, services, industrial goods, and selected consumer products.

For the automotive industry, tariffs for European exporters should fall from 110% to 10% (for a quota of over 250,000 cars/year). For importers, on the other hand, the agreement should bring easier access to spare parts. In the engineering sector, exporters will again see a significant reduction in tariffs from the current 45%, and importers will see a reduction in the cost of purchasing components. Indian textiles will be added to those from China and Bangladesh. Pharmaceuticals will gain better patent protection and easier registration in India.

Although it looks like it is already done, it is still a kind of implementation framework, and the agreement is currently undergoing legal review, translation, and other administrative steps. The agreement still has to be ratified by both parliaments, European and Indian. This is expected in the second half of 2026. The actual application of the lower or zero tariffs you are waiting for can be expected from 2027 at the earliest. For some measures, a gradual reduction to the final value over a period of 3, 5, or 10 years is even being considered.